Finance Assignment, NUN, Malaysia It Is 25 July 2022; You Observe Two Treasury Bills? What Are The Appropriate Discount Factors For 2 Months And 8 Months

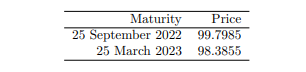

1. It is 25 July 2022; you observe two treasury bills

(a) What are the appropriate discount factors for 2 months and 8 months?

(b) What are the spot rates, with semi-annual compounding, for 2 months and 8 months?

(c) What would be a fair price for a bond, maturing on 25 March 2023, paying a 5% per annum coupon rate, with a semi-annual coupon?

(d) Now suppose that you observed a bond, maturing on 25 September 2023, paying a 1% per annum coupon rate (with semi-annual coupons), trading at a yield to maturity of 2.75%. Use the DMO formula to calculate the bond’s price.

(e) What is an appropriate discount factor for 25 September 2023?

(f) Calculate forward rates (with semi-annual compounding) from 25 September 2022 to 25 March 2023, and from 25 March 2023 to 25 September 2023.

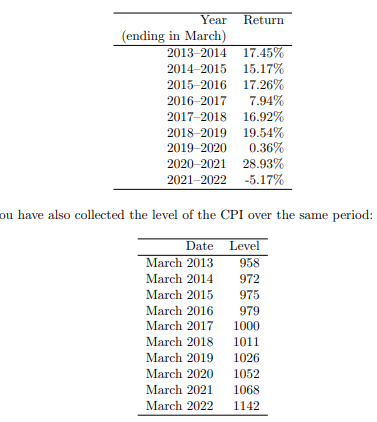

2. Over the last nine years, you have earned the following returns on the NZX

(a) For each tax year, calculate the inflation rate.

(b) Now calculate a real rate of return for the NZX50 (use the full formula, not the approximation) for each year.

(c) What is the mean nominal return for the NZX50? What is the mean real return?

(d) What is the nominal volatility for the NZX50? What is the real volatility of the NZX50?

(e) Suppose New Zealand had a 33% tax levied on capital gains and all dividends. Repeat your analysis, calculating after-tax mean real and nominal returns, along with real and nominal after-tax volatilities.

3. Third Avenue Railroad Company First Gold 5s were bonds (issued by the Third Avenue Railroad Company) that matured on 1 July 1937. They paid coupons on 1 July and 1 January. We observe the following prices